- Definition of Allowance U/S 10 of Income Tax Act 1961.

- House Rent Allowance — Section 10(13A)

- Prescribed special allowances — Section 10(14)

- Entertainment Allowance – Section 16 (ii)

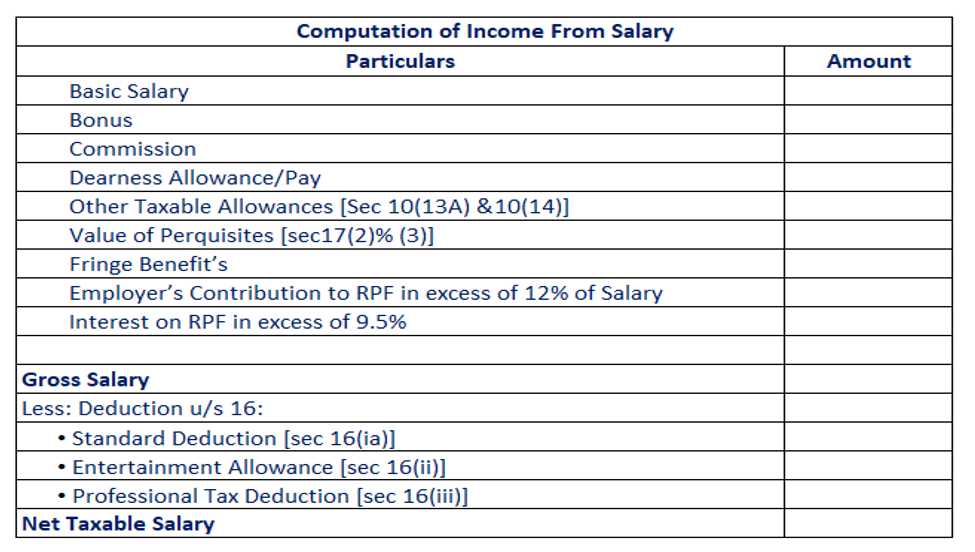

- Format for Computation of Income from Salary

Allowances are given to employees for their services or as compensation for working in unusual conditions. Section 10 of the Income Tax Act covers many allowances such as Leave Travel Allowance, Uniform Allowance, Travelling Allowance, House Rent Allowance and some more.

It is a regular Extra monetary amount given by employer to employee apart from basic salary.

Money Given for Accommodation ,Medical ,Children & Travelling Etc.

Allowance given to employee to meet his accommodation expenses.

Minimum of the following will be exempted

- Actual HRA received

- Rent Paid – 10% of Salary

- 50% (metro Cities)/40% (others cities) of salary

Salary = Basic salary + DA Conditional+ Fixed Commission(%)

DA conditional= “if under the terms of employment” or “for retirement benefit “or “dearness pay’

Taxable = Actual received – Exempted

Brief Summary of Allowances U/S 10(14), which has been divided in to four category.

- FULLY EXEMPT

- FULLY TAXABLE

- PARTLY TAXABLE

- EXEMPT UP TO CERTAIN LIMIT

- Allowances to a citizen of India, who is a Government employee, rendering services outside India.[Section 10(7)].

- Allowances to High Court judges under section 22A(2) of the High Court Judges(Conditions of Service) Act, 1954.

- Sumptuary allowance given to High Court and the Supreme Court judges. Sumptuary allowance are in the nature of entertainment allowance.

- Allowance received by an employee of United Nations Organization (UNO) from his employer.

- Dearness Allowance (DA)

- City Compensatory Allowance (CCA)

- Fixed Medical Allowance: Fully taxable, irrespective of whether any amount has been spent on medical treatment or not.

- Lunch Allowance/tiffin allowance

- Overtime Allowance 6.Servant Allowance

- Warden Allowance

- Non-practicing Allowance

- Family Allowance

- Deputation Allowance

- Capital Compensatory Allowance

- Project Allowance

- Entertainment Allowance for non-government employee

- Water and Electricity Allowance

- Holiday Trip Allowance

- Marriage Allowance

Special allowances for performance of official duties [section 10(14)(i)]

Taxable = Actual received – Actual paid

- Conveyance Allowance

- Daily Allowance

- Travelling Allowance

- Transfer Allowance

- Helper Allowance

- Academic/Research Allowance

- Uniform Allowance

The above allowances shall be exempt to the extent of minimum of the following:

- Actual Allowance Received.

- Actual amount spent for the purposes of duties of office or employment.

Allowances to meet personal expenses [section 10(14)(ii)]

- Children Education Allowance – Rs.100 pm, Per Child up to 2 Children

- Hostel Expenditure Allowance – Rs.300 pm per child upto 2 children

- Tribal Area, Scheduled / Agency Area Allowance(UP, Karnataka, Tamilnadu , Odisa , Assam & Tripura) – Rs.200 pm

- Hilly Area / High Altitude Allowance – Rs.300 to Rs.7000 pm

- Border / Remote / Disturbed Area Allowance – Rs.200/- to Rs.1300/-pm

- Field Area Allowance(J&K, Nagaland , UP, AP, Sikkim & Manipur) – Rs.2600/-pm

- Modified Field Area Allowance (military duties and where imminence of hostilities/violence and risk exist)–Rs.1000/-pm

- Counter Insurgency Allowance – to Armed force member – Rs.3900/-

- Transport Allowance – Rs.1600/- Pm & Rs.3200/-pm for handicap employee

- Underground Allowance – Rs.800/-pm

- High Altitude (Uncongenial climate) Allowance – armed forces for altitude of 9000 ft to 15000 ft Rs.1060/-pm and for altitude above Rs.1600 pm

- Highly Active Field Area Allowance – Rs.4200/-pm

- Island (duty) Allowance – Rs.3250/-pm

- Allowance to Transport Employees – 70% of Allowance maximum to Rs.10000/-pm.

This deduction is allowed only to a Government employee. Non-Government employees shall not be eligible for any deduction on account of any entertainment allowance received by them.

In case of entertainment allowance, the assessee is not entitled to any exemption but he is entitled to a deduction under section 16(ii) from gross salary. Therefore, the entire entertainment allowance received by any employee is added in computation of the gross salary. The Government employee is, then, entitled to deduction from gross salary under section 16(ii) on account of such entertainment allowance to the extent of minimum of the following 3 limits.

- Actual entertainment allowance received during the previous year.

- 20%of basic salary exclusive of any allowance, benefit or other perquisite.

- ₹5,000.