Index :

- Introduction

- Determination of Annual Value

- Deductions under House Property

- Amounts not deductible from Income from House Property

- Property owned by co-owners

- Deemed Ownership

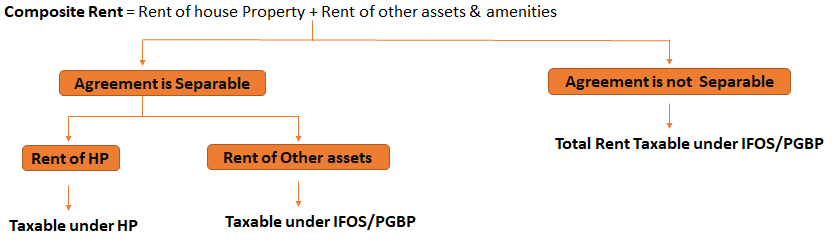

- Composite Rent

Section 22: Charging Section

Rental Income (Annual Value) is taxable under the head Income from House Property if it satisfies the following two conditions:

- There should be House Property

- Assessee should be the owner of the House Property

House Property includes buildings or lands appurtenant thereto

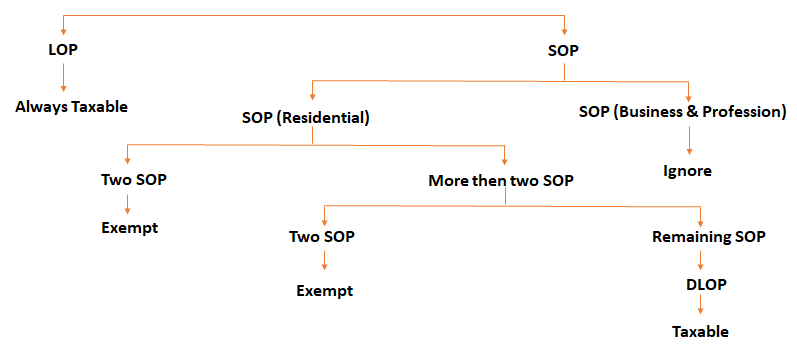

Types of House Property

- LOP : Let out Property

- DLOP : Deemed to be Let out Property

- SOP : Self Occupied Property

Section 23 : Computation of Income from House Property

Municipal Value : It Means Value of Property as per Municipality Record

Fair Rent : It means rent of Similar Property in some Locality ,also known as reasonable rent.

Standard Rent : It means Rent as per the Control Act. It is the maximum amount of rent that can be legally recovered by owner from Tenant.

Actual Rent : Rent Received (+) Rent Receivable (-) unrealized Rent.

Municipal Taxes :

- Tax which is recovered by Local Authority, Municipality, Gram Panchayat

- It is allowed on Payment Basis

- It is allowed only if it is paid by owner

- It is also known as House Tax, Property tax, Local Tax

Concept of Vacancy

1. Expected Rent ≤ Actual Rent + Vacant Rent

In this case take Actual Rent as GAV

2. Expected Rent ≥ Actual Rent + Vacant Rent

In this case take Expected Rent as GAV

Note : Where the property is held as stock-in-trade and the property or any part of the property is not let during the whole or any part of the previous year, the annual value of such property or part of the property shall be taken to be nil for a period of up to two years from the end of the financial year in which the certificate of completion of construction of the property is obtained from the competent authority.

1.Concept of Partly Let out property (Area wise)

If some area of House Property is let out and remaining is self- occupied then Let out portion will be treated as LOP & self – occupied portion will be treated as SOP. Municipal value, Fair rent, Standard rent, Municipal taxes, Interest on loan should be divided between LOP & SOP on area basis.

2.Concept of Partly Let out property (Time wise)

If Property is let out for some period of time and self- occupied for remaining period of time then such property will be treated as LOP only.

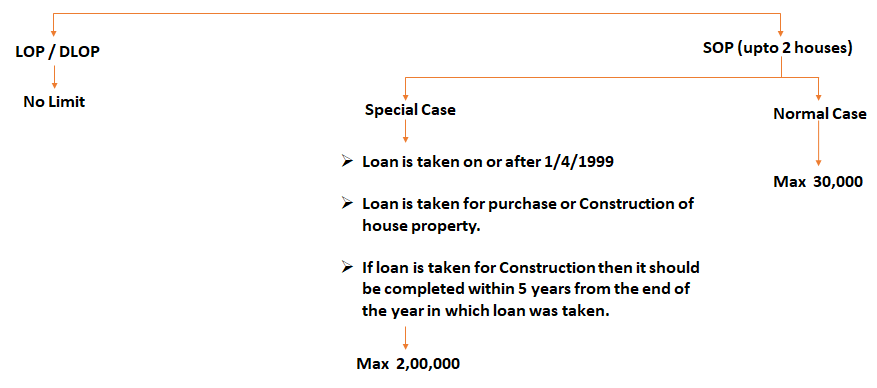

Section 24 : Deductions

Interest on Loan

- Interest on loan is allowed as deduction , if loan is taken for the purpose of house property i.e construction, repairs , renovation.

- Loan may be taken from Banks, Financial Institution, friends, family etc.

- Interest is allowed on due basis

- There are limits for Interest on Loan.

Any Fresh Loan is taken for the repayment of earlier loan & earlier loan was taken for the purpose of house property then interest of fresh loan shall be allowed as deduction.

Pre-construction Interest : It means interest paid before the year in which construction was completed. It is allowed in Five equal instalments from the year in which construction was completed.

Section 25 : Disallowance of Interest

Interest paid outside India shall not be allowed as deduction if TDS not Deducted on such Interest

Section 25A : Special Provision for Arrears of Rent and unrealized Rent

Recovery of Arrear/unrealized rent is taxable in the year in which it is recovered , whether the assessee is the owner of the property or not in that financial year.

Taxable Value = Recovery * 70% (30% std deduction)

Unrealized Rent : It means rent which is not recovered by owner from tenant. It is deductible while calculating actual rent if following four conditions are satisfied.

- Tenancy should be bonafide.

- Tenant should have vacated the house property.

- Such tenant should not occupy any other house property of the same assessee.

- Reasonable step should have been taken for Recovery of unrealized Rent.

Arrears of Rent : It means Rent under Dispute

Section 26 : Joint Ownership

Joint Ownership (Co-ownership) means property is owned by more than one owner, in this case Income from House Property is calculated normally & thereafter it should be divided between co-owners in their ownership ratio.

In the above case each co-owner will considered as individual and will be entitled to relief individually.

Section 27 : Deemed Ownership

- If any Individual transfers any house property to his / her spouse without consideration or inadequate consideration then such individual is treated as Deemed owner of such property.

Exception : Transfer in connection to live apart.

- If any Individual transfers any house property to any minor child (other than minor married daughter) without consideration or inadequate consideration then such individual is treated as Deemed owner of such property.

- In case of Co-operative Society, shareholders will be termed as deemed owner of such property.

- Holder of an impartible estate.

Note : If let out property not feasible without other assets then total rent is taxable under the head Income from Business / Profession or Income from Other Sources whether agreement is separable or not.

– Bishal Deb

Accounts Executive