- Basis of Charge

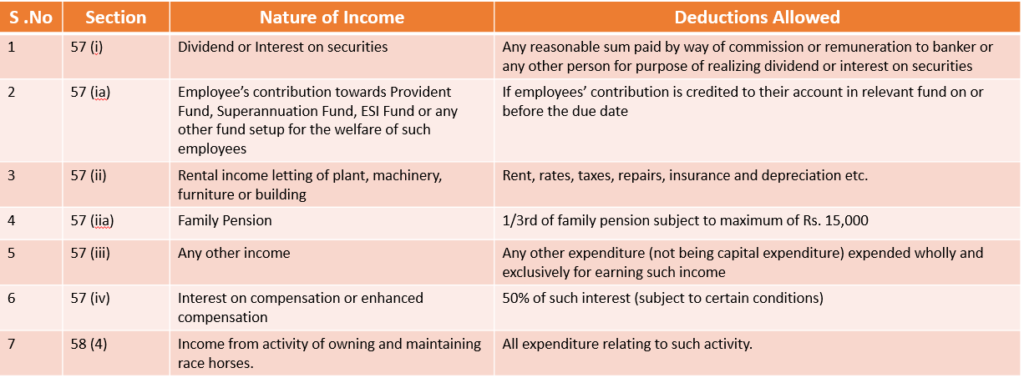

- Deductions

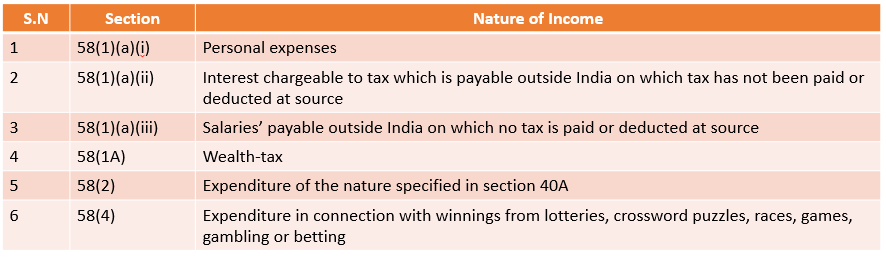

- Expenses not Deductible

Section 56

Income chargeable to tax under the head “Income from other sources” shall include following:

- Dividends

- Income by way of winnings from lotteries, crossword puzzles, races including horse races, card games, gambling or betting of any form or nature whatsoever

- Any sum received by an employer from his employees as contribution towards PF/ESI/ Superannuation Fund etc., if same is not deposited in the relevant fund and it is not taxable under the head ‘Profits and Gains from Business or Profession’

- Interest on securities, if not taxable under the head ‘Profits and Gains of Business or Profession’

- Income from machinery, plant or furniture belonging to taxpayer and let on hire, if income is not chargeable to tax under the head ‘Profits and Gains of Business or Profession’

- Composite rental income from letting of plant, machinery or furniture with buildings, where such letting is inseparable and such income is not taxable under the head ‘Profits and Gains of Business or Profession

- Any sum received under Keyman Insurance Policy (including bonus), if not taxable under the head ‘Profits and Gains of Business or Profession’ or under the head ‘Salaries’

In the following cases, any sum of money or property received by a person from any person (except from relatives or member of HUF or in given circumstances, see note 1) shall be taxable under the head ‘Income from other sources’:

a) If any sum is received without consideration in excess of Rs. 50,000 during the previous year, the whole amount shall be chargeable to tax;

Though the provisions relating to gift applies in case of every person, but it has been reported that gifts by a resident person to a non-resident are claimed to be non-taxable in India as the income does not accrue or arise in India. To ensure that such gifts made by residents to a non-resident person are subjected to tax in India, the Finance (No. 2) Act, 2019 has inserted a new clause (viii) under Section 9 of the Income-tax Act to provide that any income arising outside India, being money paid without consideration on or after 05-07-2019, by a person resident in India to a non-resident or a foreign company shall be deemed to accrue or arise in India.

b) If an immovable property is received without consideration and the stamp duty value exceeds Rs. 50,000, the stamp duty value of such property shall be chargeable to tax;

c) If immovable property is received for consideration which is less than the stamp duty value of property by higher of following amount the difference is chargeable to tax:

>> the amount of Rs. 50,000

>> the amount equal to 10% of consideration.

d) If movable properties* is received without consideration and the aggregate fair market value of such properties exceeds Rs. 50,000, the whole of aggregate fair market value of such properties shall be chargeable to tax

e) If movable properties is received for consideration which is less than the aggregate fair market value of properties by an amount exceeding Rs. 50,000, the difference between the aggregate fair market value and the consideration is chargeable to tax.

- If shares in a closely held company are received by a firm or another closely held company from any person without consideration or for inadequate consideration, the aggregate fair market value of such shares as reduced by the consideration paid, if any, shall be chargeable to tax.

Note: Nothing would be chargeable to tax if taxable amount doesn’t exceed Rs. 50,000

- If a closely held public company receives any consideration for issue of shares which exceed the fair market value of such shares, the aggregate consideration received for such shares as reduced by its fair market value shall be chargeable to tax.

Note: This provision is not applicable in the following cases:

a) Where the consideration for issue of shares is received by a venture capital undertaking from a venture capital company or venture capital fund or a specified fund.

“Specified fund” means a fund established or incorporated in India in the form of a trust or a company or a LLP or a body corporate which has been granted a certificate of registration by SEBI as a Category I or Category II Alternative Investment Fund (AIF).

b) Where the consideration for issue of shares is received by company from class or classes of person as notified by the Government.

- Any compensation received by a person in connection with the termination of his employment or modification of terms and conditions relating thereto

- Interest received on compensation or enhanced compensation

- Any sum of money received as an advance or otherwise in the course of negotiations for transfer of a capital asset shall be charged to tax under this head, if:

a) Such sum is forfeited; and

b) The negotiations do not result in transfer of such capital asset.

Note : Movable property’ shall include shares, securities, jewelry, archaeological collection, drawings, paintings, sculptures, any work of art or bullion etc.

– Bishal Deb

Accounts Executive