Index :

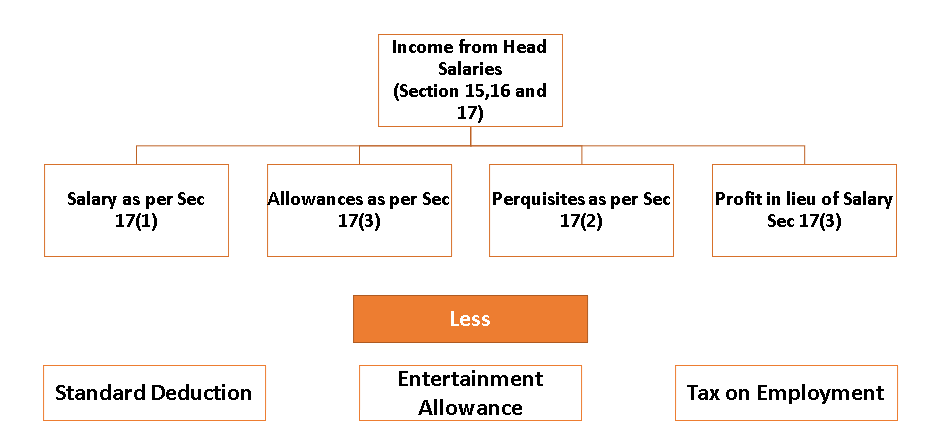

- Income from Head Salary.

- Definition.

- Valuation and Taxation of Perquisites.

- Deductions under Salary

There is no definition of perquisite as such as per Sec 2 of the Income Tax Act, 1961 however

Sec 17(2) provides inclusive definition of perquisites

As per Sec 17(2) perquisites includes:-

(i) The value of rent-free accommodation provided to the assessee by his employer;

(ii) The value of any concession in the matter of rent respecting any accommodation provided to the assessee by his employer;

- Unfurnished Accommodation

- Furnished Accommodation

(iii) The value of any benefit or amenity granted or provided free of cost or at concessional rate

- To a director of the company

- To an employee who has substantial interest in the company (substantial Interest is 25% equity shares)

- By an employer to employee not covered under (a) or (b) above which is more than Rs. 50,000/-

(iv) Any sum paid by the employer in respect of any obligation which, but for such payment, would have been payable by the assessee.

(v) Any sum payable by the employer, whether directly or through a fund, to effect an assurance on the life of the assessee or to effect a contract for an annuity.

(vi) The value of any specified security or sweat equity shares allotted or transferred, directly or indirectly, by the employer, or former employer, free of cost or at concessional rate to the assessee

(vii) The amount or the aggregate of amounts of any contribution made to the account of the assessee by the employer.

(Viii) The annual accretion by way of interest, dividend or any other amount of similar nature during the previous year to the balance at the credit of the fund or scheme referred to in sub-clause (vii).

(ix) The value of any other fringe benefit or amenity as may be prescribed.

- Motor Car Services

- Services of Sweeper, Gardner, Personal Attendant.

- Supply of Gas, Electricity, Water Charges.

- Free or Concessional Educational Facilities.

- Free or Concessional travel or transport of goods by company engaged in that business

- Interest free or Concessional Loan.

- Value of travelling accommodation touring other than business purposes

- The value of free food and non-alcoholic beverages(apart from payment from vouchers)

- Value of any gift or voucher (more than Rs 5000)

- Membership fee and annual fees incurred by employee(apart from official purpose)

- Value of benefit to the employee resulting in a club re-imbursed by employer(apart from official purposes)

- Value of benefit by transfer of moveable asset

- Value of benefit to employee resulting in using of moveable asset other than computers and laptops(10% per annum cost of the asset)

- The value of any other benefit or amenity, service, right or privilege provided by the employer(cost to employer).

Value of Specified Security or Sweat Equity Shares ;

Value of Specified Security or Sweat Equity Shares is the FMV as on which the shares are exercised by the employee

FMV of shares

- If the shares are listed in Recognized Stock Exchange it is the average price of opening and closing price as on exercise date

- If the shares are listed in multiple stock exchange it would be average price of opening and closing where the stock traded volume traded are high in which stock exchange.

- If there is no trading on the exercise date, the closest date when the stock traded date should be taken.

- If the shares are not listed in Stock Exchange it would be the Fair Market Value as determined by the *Merchant Banker on the exercise date.

Contribution made to the account of the assessee by the Employer ;

The Contribution made by the Employer in excess of Rs 7,50,000 into

- Recognized Provident Fund

- In the scheme referred to in sub-section (1)* of section 80CCD

- In an approved superannuation fund.

Contribution made to the account of the assessee by Supply of Gas, Electricity, Water Charges ;

The value of the benefit to the employee resulting from the supply of gas, electric energy or water for his household consumption shall be determined as the sum equal to the amount paid on that account by the employer to the agency supplying the gas, electric energy or water.

Where such supply is made from resources owned by the employer, without purchasing them from any other outside agency, the value of perquisite would be the manufacturing cost per unit incurred by the employer. Where the employee is paying any amount in respect of such services, the amount so paid shall be deducted from the value so arrived at.

Free or Concessional Educational Facilities ;

The value of benefit to the employee resulting from the provision of free or concessional educational facilities for any member of his household shall be determined as the sum equal to the amount of expenditure incurred by the employer

Where the educational institution is itself maintained and owned by the employer or where free educational facilities for such member of employees’ household are allowed in any other educational institution by reason of his being in employment of that employer, the value of the perquisite to the employee shall be determined with reference to the cost of such education in a similar institution in or near the locality.

Where any amount is paid or recovered from the employee on that account, the value of benefit shall be reduced by the amount so paid or recovered

Value of Travelling accommodation & Touring ;

The value of travelling, touring, accommodation and any other expenses paid for or borne or reimbursed by the employer for any holiday availed of by the employee or any member of his household, other than concession or assistance referred to in rule 2B of these rules, shall be determined as the sum equal to the amount of the expenditure incurred by such employer in that behalf.

Where such facility is maintained by the employer, and is not available uniformly to all employees, the value of benefit shall be taken to be the value at which such facilities are offered by other agencies to the public.

Where the employee is on official tour and the expenses are incurred in respect of any member of his household accompanying him, the amount of expenditure so incurred shall also be a fringe benefit or amenity:

Provided that where any official tour is extended as a vacation, the value of such fringe benefit shall be limited to the expenses incurred in relation to such extended period of stay or vacation. The amount so determined shall be reduced by the amount, if any, paid or recovered from the employee for such benefit or amenity.

Value of benefit by transfer of moveable asset ;

The value of benefit to the employee arising from the transfer of any movable asset belonging to the employer directly or indirectly to the employee or any member of his household shall be determined to be the amount representing the actual cost of such assets to the employer as reduced by the cost of normal wear and tear calculated at the rate of 10 per cent of such cost for each completed year during which such asset was put to use by the employer and as further reduced by the amount, if any, paid or recovered from the employee being the consideration for such transfer

Provided that in the case of computers and electronic items, the normal wear and tear would be calculated at the rate of 50 percent and in the case of motor cars at the rate of 20 percent by the reducing balance method.

Sec 16(ia) – a deduction of fifty thousand rupees or the amount of the salary, whichever is less

Sec 16(ii) – a deduction in respect of any allowance in the nature of an entertainment allowance specifically granted by an employer to the assessee who is in receipt of a salary from the Government, a sum equal to one-fifth of his salary (exclusive of any allowance, benefit or other perquisite) or five thousand rupees, whichever is less;

Sec 16(iii) – a deduction of any sum paid by the assessee on account of a tax on employment within the meaning of clause (2) of article 276 of the Constitution, leviable by or under any law. (Profession Tax).